Penny Stock Investing: Risks, Rewards, and Strategies for Success

Understanding the risks and rewards of investing in penny stocks is crucial because while these stocks offer the potential for high returns, they also carry significant risks, including volatility and liquidity issues that investors should carefully assess before diving in.

Are you intrigued by the allure of substantial profits but also wary of significant losses? Then, understanding the risks and rewards of investing in penny stocks is essential. Penny stocks, known for their low prices and high volatility, can be both exhilarating and daunting, making a well-informed approach crucial before you invest any money.

What Are Penny Stocks and Why Are They Appealing?

Penny stocks, often shrouded in speculation and promise, represent a unique area within the financial markets. Their accessibility and the potential for exponential returns make them an attractive option for certain investors.

These stocks, typically trading at less than $5 per share, represent small companies with limited operating history. The low price point allows investors to purchase large blocks of shares with relatively small amounts of capital.

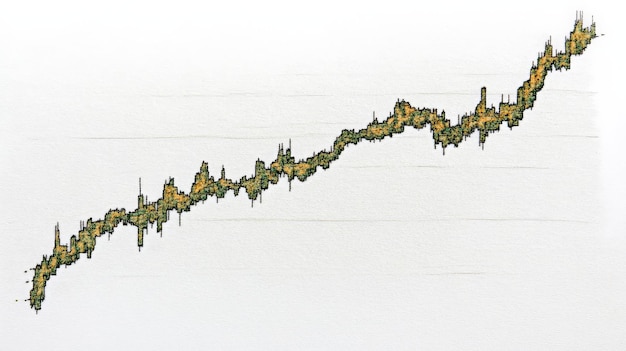

The Allure of High Returns

The primary attraction of penny stocks is the potential for explosive growth. A small price increase can translate into a significant percentage gain, offering the possibility of quick and substantial profits.

Accessibility and Entry Point

Penny stocks offer a seemingly low barrier to entry for new investors. With minimal capital, one can enter the market and participate in the stock trading experience.

- Potential for high percentage gains: Even a small increase in share price results in a significant return.

- Low initial investment: Allows investors to buy many shares without needing much capital.

- Opportunity to discover undervalued companies: Early investment in a growing company can yield substantial profits as the company matures.

Penny stocks offer a unique appeal with the potential for high returns and a low entry point for new investors. However, these advantages come with significant risks, particularly high volatility and limited liquidity, making careful assessment crucial for anyone considering investing in them.

The Significant Risks of Investing in Penny Stocks

While penny stocks can be tempting, it’s critical to acknowledge their substantial downsides. These stocks are not for the faint of heart and require careful consideration.

The risks of investing in penny stocks range from volatility and liquidity issues to the potential for fraud and misinformation. A comprehensive understanding of these risks is necessary for anyone considering this investment avenue.

Volatility and Price Manipulation

Penny stocks are notorious for their high volatility, which means that their prices can change dramatically in very short periods. This volatility can be exacerbated by pump-and-dump schemes, where promoters artificially inflate the stock price and then sell their shares for a profit, leaving other investors with losses.

Liquidity Problems

Many penny stocks trade infrequently, making it difficult to buy or sell shares when desired. This lack of liquidity can trap investors in positions they cannot easily exit, especially during market downturns.

- High volatility: Prices can change rapidly.

- Low liquidity: It can be difficult to find buyers/sellers.

- Potential for fraud: Susceptible to pump-and-dump schemes.

Penny stocks are subject to high volatility and potential fraud, making it imperative for investors to conduct thorough research, diversify their portfolio, and carefully consider their risk tolerance before investing.

Strategies for Managing Risk in Penny Stock Investments

If you decide to venture into the world of penny stocks, utilizing strategies to manage risk can help you mitigate potential losses. These strategies aim to balance the potential rewards with the inherent risks of these investments.

Diversification, due diligence, and setting clear investment criteria are vital components of a sound risk management strategy for penny stocks. Each of these elements plays a crucial role in protecting your capital.

Diversification and Portfolio Allocation

Diversification is crucial when investing in penny stocks. By spreading your investments across various stocks, you reduce the impact of any single stock’s performance on your overall portfolio, thereby mitigating risk.

Conducting Thorough Due Diligence

Due diligence involves a deep dive into the company’s financials, business model, and industry outlook. Examining these aspects can help you identify potential red flags and make informed investment decisions.

- Diversify investments: Spread investments across various stocks to reduce the impact of any single stock’s performance.

- Conduct due diligence: Research company financials and business model to identify risks.

- Set clear exit strategies: Have predetermined price targets for both gains and losses to guide decision-making.

Diversification and due diligence are essential strategies for mitigating risk when investing in penny stocks. These approaches help balance potential rewards with inherent risks, safeguarding capital and enhancing investment outcomes.

Red Flags to Watch Out For

Identifying red flags can help investors avoid potentially fraudulent or unstable penny stocks. Awareness of these indicators is essential for protecting against significant losses.

Unrealistic promises, aggressive sales tactics, and a lack of regulatory filings are critical red flags that should raise concern. These warnings indicate the potential for fraud or instability.

Unrealistic Promises and Guarantees

Be wary of stocks that promise exceptionally high returns with little to no risk. Such promises are often a sign of a pump-and-dump scheme or other fraudulent activity.

Aggressive Sales Tactics

Watch out for brokers who use high-pressure sales tactics to push penny stocks. These brokers may be more interested in earning commissions than in providing sound investment advice.

- Unrealistic promises: Be skeptical of guaranteed high returns.

- Aggressive sales tactics: Watch out for brokers using high-pressure sales techniques.

- Lack of regulatory filings: Ensure the company complies with SEC regulations and files necessary reports.

Being vigilant about unrealistic promises and aggressive sales tactics is crucial for avoiding fraudulent penny stocks and preserving investment capital. Recognizing these red flags can enhance financial security.

The Role of Regulatory Oversight

Regulatory agencies play a vital role in overseeing the penny stock market, helping to protect investors from fraud and manipulation. These agencies enforce rules and regulations to ensure fair practices.

The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are key players in overseeing the penny stock market. They set rules, conduct audits, and take enforcement actions against those who violate the law.

SEC and FINRA Regulations

The SEC and FINRA require brokers to provide investors with detailed information about penny stocks, including risks and disclosures. They also monitor trading activity to detect and prevent fraud.

Investor Protection Measures

These regulatory bodies offer investor education resources and handle complaints against brokers and companies. Their efforts help maintain market integrity and protect investors from unfair practices.

- SEC and FINRA regulations: These bodies provide detailed information about penny stocks, including risks and disclosures.

- Investor protection measures: They offer investor education resources and handle complaints to ensure fair market practices.

Regulatory agencies and their investor protection measures play a crucial role in safeguarding financial markets. Through regulatory oversight and proactive vigilance, investors can navigate the complex landscape of penny stock investments with greater confidence.

How to Get Started with Penny Stock Investing

If, after careful consideration, you decide to invest in penny stocks, there are several steps you should take to get started safely and effectively. These steps involve opening an account and understanding market dynamics.

Select a broker that provides access to penny stocks, conduct thorough research on potential investments, and manage your risk by setting stop-loss orders. These components form a foundation for responsible penny stock investing.

Choosing the Right Broker

Select a brokerage firm that offers access to the over-the-counter (OTC) market, where many penny stocks are traded. Ensure the broker is reputable and offers robust research tools.

Understanding Market Dynamics

Educate yourself about how penny stocks are traded and the factors that influence their prices. This knowledge will help you make more informed decisions and avoid common pitfalls.

- Choose the right broker: Select a firm providing access to the OTC market and robust research tools.

- Understand market dynamics: Educate yourself on how penny stocks are traded and the factors influencing prices.

- Start with a small amount: Begin with a minimal investment to gain experience without exposing yourself to undue risk.

Selecting the right broker and understanding market dynamics are vital initial steps for investing in penny stocks. By doing so, investors can navigate the risks more confidently.

| Key Point | Brief Description |

|---|---|

| ⚠️ Risk Awareness | Penny stocks involve high volatility and potential fraud. |

| 🔍 Due Diligence | Research company financials and regulatory filings. |

| 🛡️ Diversification | Spread investments to reduce risk from any single stock. |

| 🛑 Red Flags | Avoid stocks with unrealistic promises or aggressive sales. |

FAQ

▼

Penny stocks are shares of small public companies that trade for less than $5 per share. They’re often associated with higher risk but potentially higher rewards due to their volatility and growth potential.

▼

Penny stocks are risky due to limited information, low liquidity, and susceptibility to manipulation. These factors can lead to significant price swings and potential losses for investors.

▼

To minimize risk, conduct thorough research, diversify your investments across multiple stocks, set stop-loss orders, and allocate only a small portion of your portfolio to penny stocks.

▼

Penny stocks are generally not suitable for novice or risk-averse investors. They are better suited for experienced investors who can handle significant volatility and have a high-risk tolerance.

▼

The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) oversee penny stocks, enforcing rules and regulations to protect investors from fraud and manipulation.

Conclusion

Investing in penny stocks can offer substantial rewards for those willing to accept the associated risks. A well-informed, disciplined approach, combined with strategic risk management, is essential for navigating this volatile market successfully.