Financial Literacy for Entrepreneurs: Cash Flow Mastery and Growth

Financial literacy for entrepreneurs is essential for managing cash flow and achieving sustainable business growth by understanding financial statements, budgeting, and investment strategies.

For entrepreneurs, financial literacy for entrepreneurs: managing cash flow and growing your business extends beyond basic accounting. It’s about strategic financial planning that fuels growth and ensures long-term sustainability. This guide provides actionable tips to effectively manage your business finances.

Understanding Financial Statements for Entrepreneurs

Financial statements are critical tools for any business owner. They provide a snapshot of your company’s financial health, helping you make informed decisions about operations, investments, and growth strategies. Understanding these statements is a fundamental aspect of financial literacy for entrepreneurs.

The Balance Sheet

The balance sheet offers a picture of what your company owns (assets) and owes (liabilities) at a specific point in time, along with the owner’s equity. It’s a snapshot that reveals your company’s net worth.

The Income Statement

The income statement, also known as the profit and loss (P&L) statement, shows your company’s financial performance over a period, detailing revenues, expenses, and net income or loss.

Understanding these key components will allow you to see if your business is making a profit or a loss. Here are the factors that help you understand:

- Reviewing Revenue Streams: Identifying which products or services are generating the most income.

- Analyzing Expenses: Pinpointing areas where costs can be reduced without affecting quality.

- Calculating Net Profit: Determining the actual profit after all expenses are paid.

By regularly analyzing these statements, entrepreneurs can identify trends, assess performance, and make strategic adjustments. They enable you to catch problems early and capitalize on opportunities as they arise. This is a cornerstone of financial literacy for entrepreneurs.

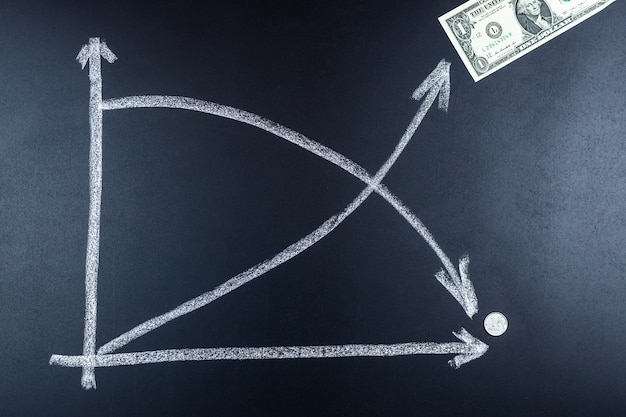

Mastering Cash Flow Management

Cash flow is the lifeblood of any business. Effective cash flow management ensures you have enough money to meet your obligations, invest in growth, and weather unexpected financial storms. It’s arguably the most critical financial skill for entrepreneurs.

Creating a Cash Flow Forecast

Forecasting your cash flow involves estimating the money expected to come in and go out of your business over a specific period. This helps you anticipate shortfalls and surpluses, allowing for proactive planning.

Strategies for Improving Cash Flow

Improving cash flow involves accelerating inflows and decelerating outflows. This can be achieved through a variety of strategies that can improve the stability of your business.

Here are some strategies with proven results:

- Offer Early Payment Discounts: Incentivize customers to pay invoices quickly.

- Negotiate Payment Terms with Suppliers: Extend payment deadlines to free up cash.

- Manage Inventory Efficiently: Avoid overstocking, which ties up capital.

- Invoice Promptly: Send invoices as soon as goods or services are delivered.

Effective cash flow management requires constant monitoring and adjustment. By mastering these techniques, entrepreneurs can ensure their businesses remain financially stable and prepared for growth. It’s a critical component of financial literacy for entrepreneurs.

Budgeting for Business Success

Budgeting is a vital tool for entrepreneurs to manage their finances effectively. It involves creating a detailed plan of how your business will use its financial resources over a specific period, typically a year. A well-crafted budget helps you control expenses, allocate funds strategically, and achieve your financial goals.

Creating a Realistic Budget

A realistic budget starts with a thorough assessment of your current financial situation. This includes analyzing past income and expenses, identifying trends, and understanding your company’s financial strengths and weaknesses. Always have a buffer for unexpected issues.

Sticking to Your Budget

Creating a budget is only half the battle; sticking to it requires discipline and consistent effort. Regular monitoring and adjustments are essential to ensure your budget remains relevant and effective.

To help maintain your current budget, consider the items below:

- Regular Budget Reviews: Compare actual performance against budgeted figures.

- Adjusting for Variances: Identify and address any significant discrepancies.

- Seeking Expert Advice: Consult with financial advisors to refine your budgeting process.

Budgeting is an ongoing process that requires regular attention and adaptation. By embracing this discipline, entrepreneurs can gain greater control over their finances and drive their businesses towards success. Understanding the importance of budgeting, is a massive part of achieving financial literacy for entrepreneurs.

Leveraging Financial Tools and Technology

In today’s digital age, numerous financial tools and technologies are available to help entrepreneurs manage their finances more efficiently. These tools can automate tasks, provide valuable insights, and improve decision-making, making financial management more accessible than ever.

Accounting Software

Accounting software, such as QuickBooks, Xero, and Sage, can streamline your bookkeeping processes. These platforms automate tasks like invoicing, expense tracking, and financial reporting, saving you time and reducing errors.

Budgeting and Forecasting Tools

Budgeting and forecasting tools help you create and manage your budget, forecast future financial performance, and identify potential risks and opportunities. They provide real-time insights that can inform your financial decisions.

Here are some features these programs offer:

- Automated Reporting: Generate financial statements quickly and accurately.

- Cash Flow Forecasting: Predict future cash inflows and outflows.

- Expense Tracking: Monitor and categorize expenses in real time.

Leveraging financial tools and technology can significantly enhance your financial management capabilities. By adopting these solutions, entrepreneurs can save time, reduce errors, and make more informed decisions. Finding the right software that works with your business operations will help boost your financial literacy for entrepreneurs.

Understanding Business Loans and Financing Options

Access to capital is often crucial for business growth, whether you need funds to expand operations, invest in new equipment, or manage cash flow gaps. Understanding the various business loan and financing options available is essential for entrepreneurs.

Types of Business Loans

There are several types of business loans, each designed to meet different needs and circumstances. Common options include term loans, lines of credit, SBA loans, and microloans.

Evaluating Financing Options

When evaluating financing options, consider factors such as interest rates, repayment terms, loan amounts, and eligibility requirements. Choose the option that aligns best with your financial situation and business goals.

Before agreeing to a loan, be sure to analyze these factors:

- Compare Interest Rates: Seek out the most competitive rates to minimize borrowing costs.

- Assess Repayment Terms: Understand the length of the repayment period and monthly payments.

- Review Eligibility Requirements: Ensure you meet the lender’s criteria before applying.

Entrepreneurs must carefully assess their financing needs and explore available options to make informed decisions. By understanding the pros and cons of each option, you can secure the capital you need to achieve your business goals. Understanding these loans proves your financial literacy for entrepreneurs.

Tax Planning and Compliance for Entrepreneurs

Tax planning and compliance are critical aspects of financial literacy for entrepreneurs. Effective tax planning can help you minimize your tax liabilities, while compliance ensures you meet all legal requirements, avoiding penalties and audits.

Understanding Tax Obligations

Entrepreneurs must understand their tax obligations, which vary depending on their business structure, industry, and location. Common taxes include income tax, self-employment tax, sales tax, and payroll tax.

Strategies for Tax Planning

Developing a tax strategy is essential to minimize your tax burden legally. This can involve taking advantage of deductions, credits, and other tax-saving opportunities. Strategies such as depreciation and retirement plans can considerably decrease your tax liabilities.

Here are a few of the important factors to consider:

- Keep Accurate Records: Maintain detailed records of income, expenses, and assets.

- Take Advantage of Deductions: Claim all eligible deductions to reduce your taxable income.

- Seek Professional Advice: Work with a tax advisor to optimize your tax strategy.

Tax planning and compliance are ongoing processes that require careful attention to detail. By staying informed and proactive, entrepreneurs can minimize their tax liabilities and ensure compliance with all relevant laws and regulations. This can prove to be extremely helpful for a company’s financial literacy for entrepreneurs plan.

| Key Point | Brief Description |

|---|---|

| 📊 Financial Statements | Understand balance sheets and income statements to track financial health. |

| 💰 Cash Flow Management | Improve cash flow with forecasts, discounts, and efficient invoicing. |

| ✅ Budgeting | Create and stick to a budget, regularly reviewing and adjusting as needed. |

| 🏦 Financing Options | Evaluate loan types and financing options to support business growth. |

Frequently Asked Questions

▼

Financial literacy allows entrepreneurs to make informed decisions, manage cash flow effectively, and plan for the future. It helps in understanding financial statements, budgeting, and investment strategies.

▼

Entrepreneurs can improve cash flow by offering early payment discounts, negotiating payment terms with suppliers, managing inventory efficiently, and invoicing promptly. Regular cash flow forecasting is also essential.

▼

A comprehensive budget includes projected income, expenses, and capital expenditures. It should also account for unexpected costs and regularly be reviewed and adjusted to ensure accuracy.

▼

Accounting software like QuickBooks and Xero can automate bookkeeping. Budgeting tools help create and manage budgets, while forecasting tools predict financial performance, all aiding in smart financial management.

▼

Entrepreneurs should consider interest rates, repayment terms, loan amounts, and eligibility requirements. Comparing different loan options ensures you find the best fit for your business needs and financial situation.

Conclusion

Financial literacy for entrepreneurs: managing cash flow and growing your business is an ongoing journey that requires dedication and continuous learning. By mastering these essential skills, entrepreneurs can build financially stable and thriving businesses that contribute to the growth and success of their communities. Embrace financial education and empower your entrepreneurial journey today, ensuring the long term stability for your company.